Table of Contents

- การประชุม FOMC วันที่ 2-3 พ.ค. 2566 คาดเฟดมีแนวโน้มขึ้นดอกเบี้ยนโยบาย ...

- 【12月FOMC解説】政策金利見通しが上方修正もドル高は限定的<FX MARKET VIEW>|マネーサテライト(マネサテ) - 松井証券

- Decisão de Política Monetária do FOMC | BDSwiss Blog

- [미국증시] FOMC 결과에 촉각...3대 지수 나스닥만 소폭 상승 : 네이버 블로그

- Federal Reserve FOMC Minutes & Statements Dataset | Kaggle

- [그래픽] 미 FOMC 위원 기준금리 전망 | 연합뉴스

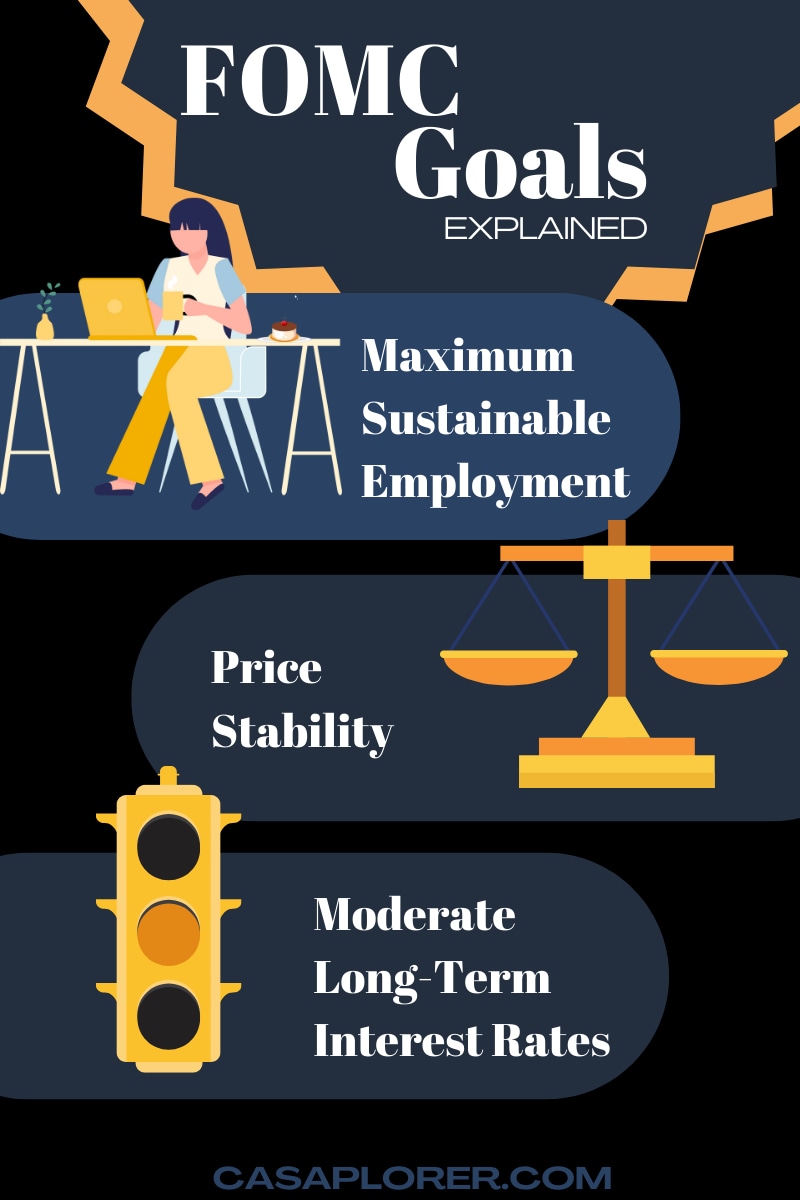

- FOMC Meetings 2022 and 2023 | Casaplorer.com

- Could September's FOMC Meeting Trigger a Stock Market Crash?

- Belajar Mengenal The FED dan FOMC - Lab Forex

- Fomc Meetings 2024 - Bessie Valeria

![[그래픽] 미 FOMC 위원 기준금리 전망 | 연합뉴스](https://img6.yna.co.kr/etc/graphic/YH/2022/09/22/GYH2022092200130004400_P4.jpg)

Economic Growth Projections

Unemployment Rate Projections

Inflation Projections

Inflation is another key area of focus for the FOMC, and the March 2025 summary provides some insights into the Committee's expectations. The median projection for inflation, as measured by the personal consumption expenditures (PCE) price index, is 2.0% in 2025. This is slightly higher than the 1.9% projected in the previous summary, reflecting the ongoing impact of supply chain disruptions and other factors.![[미국증시] FOMC 결과에 촉각...3대 지수 나스닥만 소폭 상승 : 네이버 블로그](https://blogthumb.pstatic.net/MjAyMjA2MTVfMjEw/MDAxNjU1MjQyMDI2OTkz.D867EJrEg8UaauszJUXd0yI4xcqLLs5s33aG1k1xRH8g.cZGZBG9fRAS3pJuquialPGCGPFqKzGSiJRMh2cvY7-8g.JPEG.ktn8404/Screenshot%A3%DF20220615%A3%AD055047%A3%DFWebull.jpg?type=w2)

Interest Rate Projections

The FOMC's interest rate projections are always closely watched, as they have a significant impact on the economy. According to the March 2025 summary, the median projection for the federal funds rate is 1.9% in 2025, which is slightly higher than the 1.6% projected in the previous summary. This suggests that the FOMC expects to continue gradually raising interest rates to keep the economy growing at a sustainable pace. The March 2025 FOMC Summary of Economic Projections provides valuable insights into the Federal Reserve's economic outlook. While the economy is expected to continue growing, the pace of growth is expected to be moderate, and the labor market is expected to remain strong. Inflation is expected to remain low, and interest rates are expected to continue rising gradually. These projections have important implications for businesses, investors, and individuals, and will be closely watched in the coming months.For more information on the FOMC Summary of Economic Projections, visit the FRED Blog. The FRED Blog provides timely and informative articles on economic trends, data releases, and other topics related to the US economy.

Note: This article is based on the data available up to March 2025 and is subject to change as new data becomes available. The projections and forecasts mentioned in this article are based on the FOMC's Summary of Economic Projections and are subject to uncertainty and revision.