Table of Contents

- 3 Reasons to Buy Costco Stock After Strong Earnings Show Business Strength

- Costco stock price analysis: a pullback cannot be ruled out

- Costco Stock Split [Everything You Need to Know] | DATAROMA

- Read This Before You Sell Costco Stock | Investopedia

- Costco Wholesale Corporation (COST) Stock Will Fizzle Out. Fade It.

- Costco (COST) Stock News and Forecast: What to expect from COST ...

- Stock of the week: “Costco Wholesale Corp” | UMushroom

- Costco (COST) Stock News and Forecast: What to expect from COST ...

- Costco Stock Holds Major Support on the Dip. Now What? - TheStreet

- The share price of Costco. | Download Scientific Diagram

Costco Wholesale, one of the world's largest retailers, has been a staple in the stock market for decades. With a loyal customer base and a business model that focuses on offering high-quality products at discounted prices, Costco has consistently delivered strong financial performance. In this article, we will delve into the world of Costco Wholesale (COST) stock price and provide an in-depth analysis of the company's stock performance, financials, and future prospects.

Company Overview

Costco Wholesale, founded in 1983, is a multinational retailer that operates a chain of membership-based warehouse clubs. The company offers a wide range of products, including groceries, electronics, clothing, and home goods, at discounted prices to its members. With over 785 warehouse clubs worldwide, Costco has become a household name, synonymous with bulk shopping and savings.

Stock Price Performance

Costco's stock price has been a consistent performer over the years, with a steady increase in value. As of the latest trading session, the stock price of Costco Wholesale (COST) is around $540 per share. The company's market capitalization stands at over $240 billion, making it one of the largest retailers in the world. The stock has a dividend yield of around 0.8% and a price-to-earnings ratio of 38.5, indicating a relatively stable and profitable business.

![Costco Stock Split [Everything You Need to Know] | DATAROMA](https://dataromas.org/wp-content/uploads/2022/10/Costco-Stock-Split-758x515.jpg)

Financial Performance

Costco's financial performance has been impressive, with the company reporting consistent revenue growth and profitability. In the latest fiscal year, Costco reported net sales of $163 billion, a 9.5% increase from the previous year. The company's net income stood at $4.3 billion, with a net margin of 2.6%. Costco's strong financial performance is a testament to its ability to maintain a loyal customer base and adapt to changing market trends.

Stock Analysis

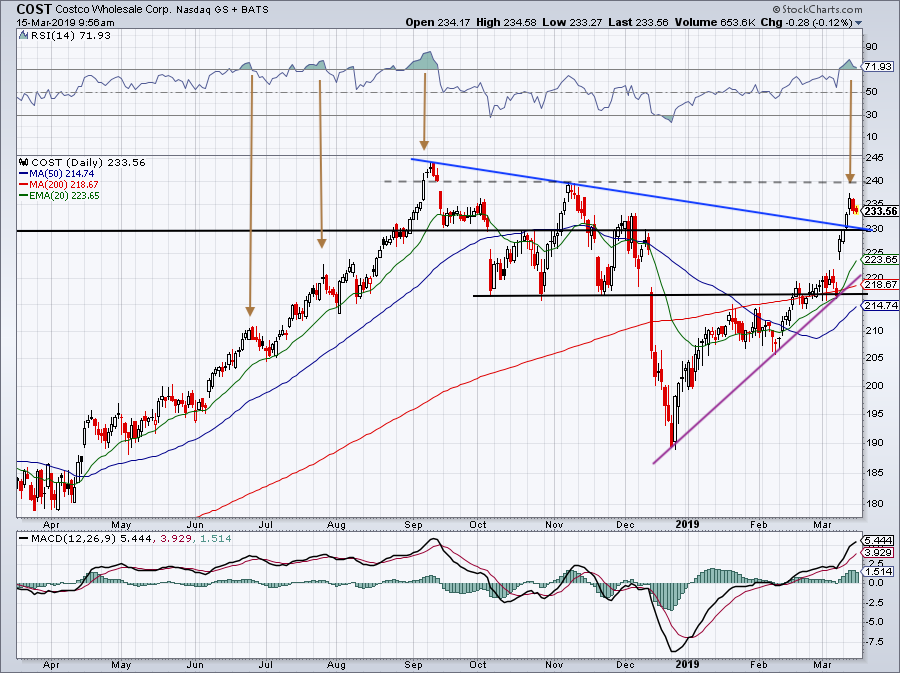

From a technical analysis perspective, Costco's stock price has been trending upwards, with a strong support level at around $450 per share. The stock's relative strength index (RSI) is around 60, indicating a neutral trend. The moving average convergence divergence (MACD) indicator is also showing a bullish trend, with the stock price above the 50-day and 200-day moving averages.

From a fundamental analysis perspective, Costco's strong financial performance, loyal customer base, and consistent dividend payments make it an attractive investment opportunity. The company's ability to adapt to changing market trends, such as the rise of e-commerce, has also been impressive. However, the stock's high price-to-earnings ratio and relatively low dividend yield may deter some investors.

In conclusion, Costco Wholesale (COST) stock price has been a consistent performer over the years, with a strong financial performance and a loyal customer base. While the stock's high price-to-earnings ratio and relatively low dividend yield may be a concern for some investors, the company's ability to adapt to changing market trends and its consistent dividend payments make it an attractive investment opportunity. As with any investment, it is essential to conduct thorough research and consider individual financial goals and risk tolerance before making a decision.

Investors looking to invest in Costco Wholesale (COST) stock can do so through various online trading platforms, such as Robinhood, Fidelity, or Vanguard. It is essential to keep in mind that investing in the stock market involves risks, and it is crucial to diversify your portfolio to minimize losses.

Overall, Costco Wholesale (COST) stock price is a solid investment opportunity for those looking for a stable and profitable business with a strong track record of financial performance. With its loyal customer base, consistent dividend payments, and ability to adapt to changing market trends, Costco is an attractive addition to any investment portfolio.